While the world is getting more interconnected, it is also seemingly getting less patient. Some companies, like Activision Blizzard, Inc. (NASDAQ: ATVI), are learning this the hard way.

Despite booking positive results, the market seems to be severely punishing the company that announced not one but two delays for some of its most popular products.

View our latest analysis for Activision Blizzard

Q3 Earnings Results

- Non-GAAP EPS: US$0.72 (beat by US$0.02)

- GAAP EPS: US$0.82 (beat by US$0.14)

- Revenue: US$1.88b (in-line)

- Revenue growth: +6.22% Y/Y

Overall results were solid with an increase in net bookings (US$1.88b vs. US$1.77b), with consistent in-game bookings of US$1.2b. Operating cash flow increased as well to US$521m.

However, the company is conservative in Q4 predictions, guiding the net bookings US$140m below the US$2.92b consensus and below the US$8.79b full-year expectations for the same amount. Finally, the bomb went off when the company announced delaying two of its key franchise games, Overwatch 2 and Diablo IV.

This is a significant setback as Overwatch was one of the top-selling games of all time, while the Diablo franchise is one of the most known in history, spanning over four decades.

What's the opportunity in Activision Blizzard?

According to our valuation, the intrinsic value for the stock is $107.50, but it is currently trading at US$77.67 on the share market, meaning that there is still an opportunity to buy.

Another thing to remember is that Activision Blizzard's share price may be pretty stable relative to the rest of the market, as indicated by its low beta. This means that if you believe the current share price should move towards its intrinsic value over time, a low beta could suggest it is not likely to reach that level anytime soon, and once it's there, it may be hard to fall back down into an attractive buying range again.

What does the future of Activision Blizzard look like?

Future outlook is an important aspect when you're buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it's the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a reasonable price.

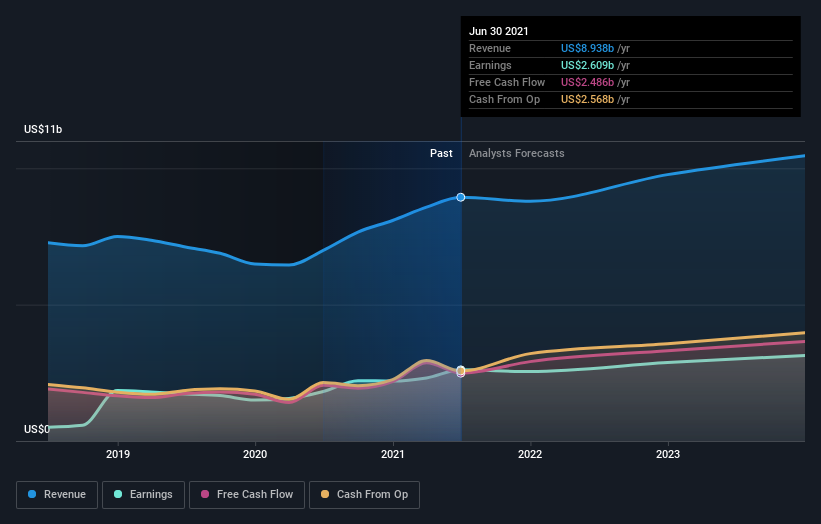

With profit expected to grow by 23% over the next couple of years, the future seems fine for Activision Blizzard, although slow in its arrival. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What this means for you:

While ATVI took a brand image hit in recent months, the company is improving the situation.

CEO Bobby Kotick recently took a significant pay cut and pledged a US$250m investment over the next decade in initiatives in gaming and technology that provide opportunities for under-represented communities.

However, public relations work can only do so much. After all, the cash flow depends on whether or not the company is selling its products -and what is not yet released cannot be sold.

Are you a shareholder? Think about the time horizon of your investment. If you are an avid gamer, you might have an extra edge over the investing community regarding gaming stocks. With an optimistic outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as capital structure to consider, which could explain the current undervaluation.

Are you a potential investor? Are you willing to predict where the stock might bottom out? Are you ready to be waiting and possibly averaging entries in your position? Do you have better investment alternatives right now?

Before you make any investment decisions, consider other factors such as the track record of its management team to make a well-informed investment decision.

Since timing is quite important when it comes to individual stock picking, it's worth taking a look at what those latest analysts' forecasts are. So feel free to check out our free graph representing analyst forecasts.

If you are no longer interested in Activision Blizzard, you can use our free platform to see our list of over 50 other stocks with high growth potential.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Article From & Read More ( PR is Not Enough to Stop the Activision Blizzard's (NASDAQ:ATVI) Falling Knife - Simply Wall St )https://ift.tt/3nO03zU

Technology

Bagikan Berita Ini

0 Response to "PR is Not Enough to Stop the Activision Blizzard's (NASDAQ:ATVI) Falling Knife - Simply Wall St"

Post a Comment